Ad Compare Your 2022 Tax Bracket vs. Therefore If you file an amended 2018 federal return due solely to changes made to the Internal Revenue Code IRC after March 1 2020 do not file an amended 2018 New York State tax return.

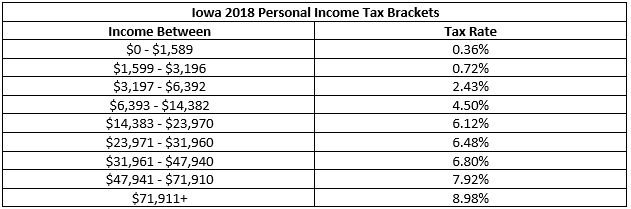

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

The 2018 tax rates are 10 12 22 24 32 35 and 37.

. Income Tax Brackets and Rates. The more you earn the higher your rate of tax. Single or Married filing sepa-rately12000.

In Ontarios 2018-19 budget tabled on 28 March 2018 the previous government proposed to eliminate the surtax and make consequential adjustments to personal. Married filing jointly or Qualify-. 2018 to 2019.

The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. The tax rates include the provincial surtaxes and reflect budget proposals and news releases up to 15 June 2018. To get a copy of your tax return write a letter or complete form FTB 3516 Request for Copy of Personal Income Tax or Fiduciary Return.

Tax on this income. Ad TurboTax Can Help You With All Your Previous Years Tax Questions. Individual income tax rates for prior years.

The amount of income tax and the tax rate you pay depends on how much you earn. 20 on annual earnings above the PAYE tax threshold and up to 34500. Tax rates for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts.

10 of the taxable income. How to calculate Federal Tax based on your Annual Income. For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018.

And dont forget. Discover Helpful Information And Resources On Taxes From AARP. 0 9525 10 of the amount over 0 If your filing status is Married Filing Jointly MFJ or Qualifying Widower.

That amount is unchanged from 2017. Employees who earn not more than the National Minimum Wage currently N30000 are no longer liable to tax or deduction of. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Rate Tax payable Cumulative income Cumulative tax GH GH GH GH First 261 0 0 261 0 Next 70 5 350 331 350 Next 100 10 10 431 1350 Exceeding 3241 25 The chargeable income of non-resident individuals is generally taxed at a flat rate of 20. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. A tax bracket is the range of incomes taxed at given rates which typically differ depending on filing status.

Income from employment An individuals income from employment for a calendar year is the. If your taxable income is. 1360 plus 12 of excess over 13600.

In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 and 2. To calculate your North Carolina tax liability multiply your North Carolina taxable income by 5499 005499. Dont Wait File Today.

Questions On Your 2018 Taxes. For 2018 most tax rates have been reduced. The 2017 Budget made no changes to the personal income tax scale for residents.

How to Figure Tax Using the 2018 California Tax Rate Schedules. Individual income taxes are a major source of state. Over - But not over - The tax is.

Single filer AGI 50K no kids Age 65 not disabled. Change in tax rates. However the temporary budget levy of 2 on higher income earners 180000 ends on 30 June 2017 according to its original 3-year time frame.

Where a taxpayer has no taxable income because of personal reliefs and allowances or total income produces a tax lower than the minimum tax a minimum tax rate of 1 of the total income is payable. Your 2021 Tax Bracket To See Whats Been Adjusted. Standard deduction amount in-creased.

UK basic tax rate. Calculation of WA personal income tax Standard deduction 5000 Personal exemption 2900 Tax due 1600 Taxable 42100 AGI 50000 Calculate a flat rate 34 tax for an average taxpayer. State Individual Income Tax Rates and Brackets for 2015.

Combined federal and provincial personal income tax rates - 2018126 1. TurboTax Experts Can Help You File Today. Visit our Tax Center for more information or make a tax office appointment to speak to one of our tax pros.

For tax years 2017 and 2018 the individual income tax rate is 5499. Over 13600 but not over 51800. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

For tax years beginning before January 1 2022 New York State personal income tax is decoupled from any changes made to the IRC after March 1 2020. The FTB keeps personal income tax returns for three and one-half years from the original due date. Chris and Pat Smith are filing a.

2018 Individual Tax Rate Table If your filing status is Single. Resident tax rates for 201819. 19c for each 1 over 18200.

These new rates will apply for those who have accumulated their income from January 2018 to December 2018 and are filing their taxes from March April 2019. For 2018 the standard deduction amount has been in-creased for all filers. This page provides detail of the Federal Tax Tables for 2018 has links to historic Federal Tax Tables which are used within the 2018 Federal Tax Calculator and has supporting links to each set of state.

The 2018 Tax Calculator uses the 2018 Federal Tax Tables and 2018 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Tax Rates 2017-2018 Year Residents. For 2018 the penalty is equal to 25 of your AGI or 695 per adult and 34750 per child up to a maximum of 2085 whichever is higher.

Minimum income tax.

State Corporate Income Tax Rates And Brackets Tax Foundation

How The Tcja Tax Law Affects Your Personal Finances

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How The Tcja Tax Law Affects Your Personal Finances

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Jbg Accounting Consultancy New Tax Table 2018 2022 Facebook

Tax Rates For Year Of Assessment 2018 T Plctaxconsultants

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

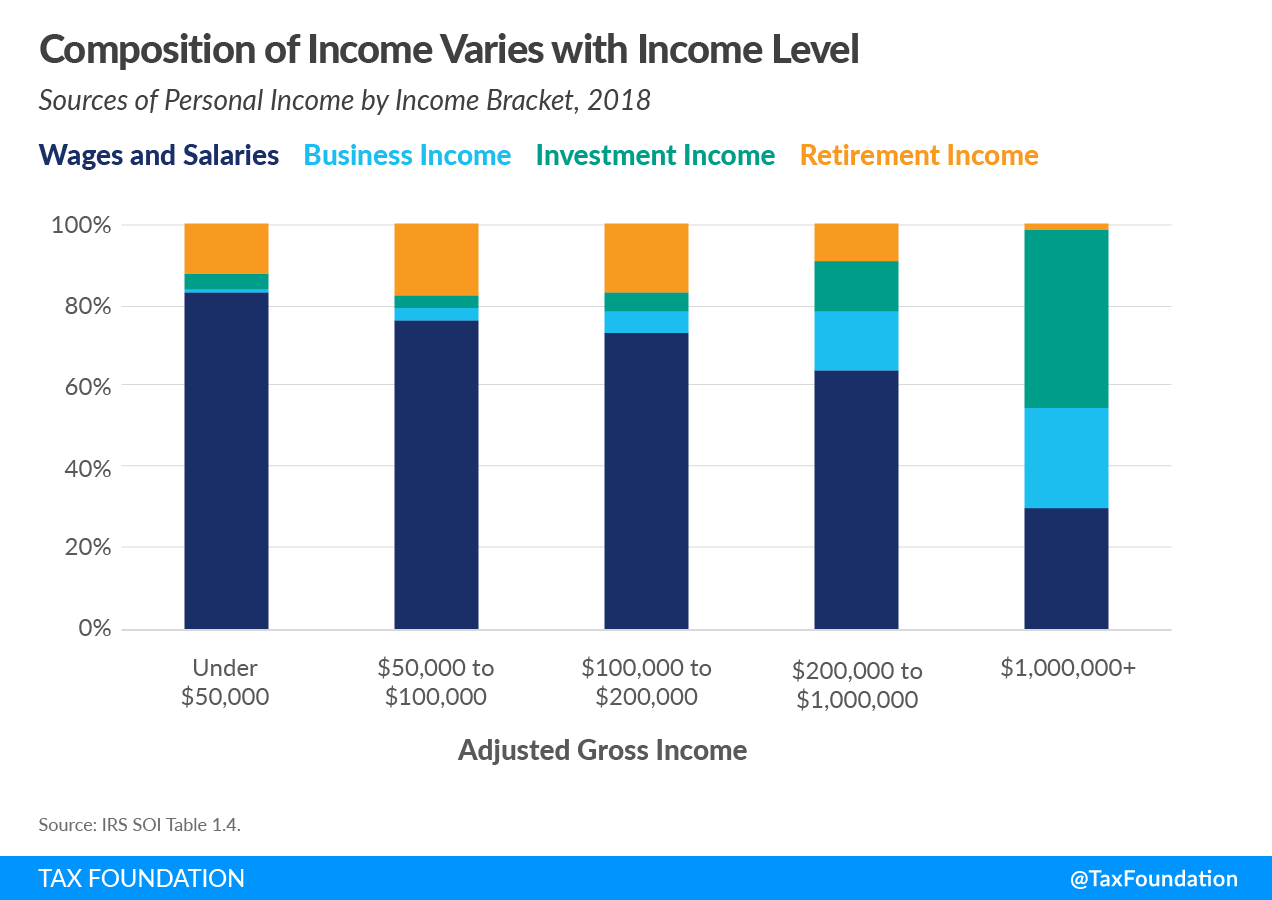

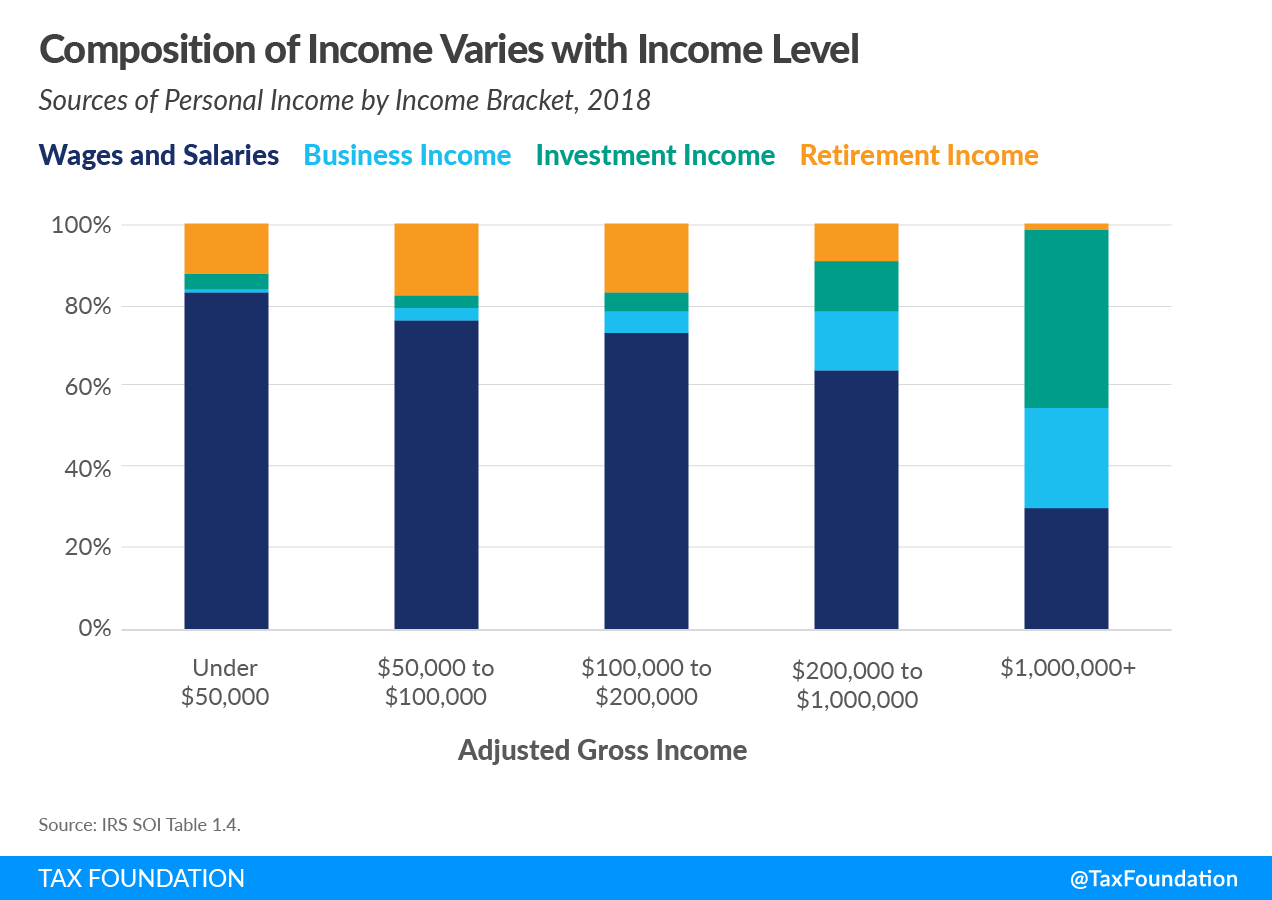

Sources Of Personal Income In The United States Tax Foundation

How Much Does A Small Business Pay In Taxes

Who Pays U S Income Tax And How Much Pew Research Center

Taxtips Ca Business 2020 Corporate Income Tax Rates

How Do State And Local Individual Income Taxes Work Tax Policy Center

Who Pays U S Income Tax And How Much Pew Research Center

Sources Of Personal Income In The United States Tax Foundation

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times